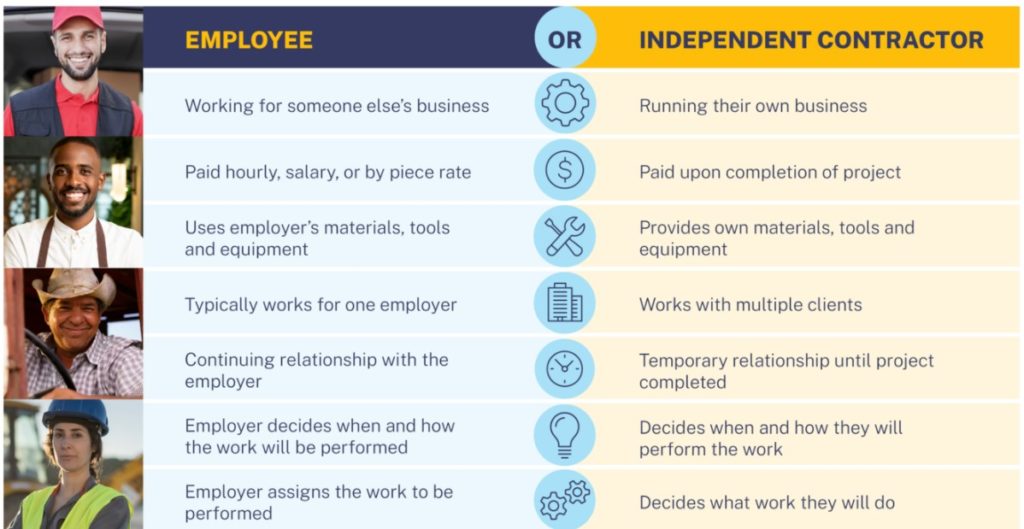

There is a lot of buzz around the question of how to classify certain employees. Some employees expect to be paid as independent contractors, others wish to be classified as W2 employees. Likewise, employers have different tolerances and preferences for this as well.

The unfortunate reality is that there are guidelines that govern this distinction. It is not really up to the employee or the employer. Those who disregard these guidelines, do so at the risk of incurring some very heavy fines.

Per the IRS and Department of Labor regulations, for 1099 to apply, the employer must answer “yes” to all three:

___ The worker is free from the control and direction of the hiring entity in connection with the work’s performance, both under the contract for the performance of the work and in fact.

___ The worker performs work that is outside the usual course of the hiring entity’s business.

___ The worker is customarily engaged in an independently established trade, occupation, or business of the same nature as the work performed.

This is known as the “ABC test”. To help clarify these, imagine you hired me as your bookkeeper.

For the first test, this means that the work on your books and when it took place would not be decided by you. When and how I meet the obligations of your agreement would be in my control. So, if you govern the hours your “employee” works, this should be a “no”.

For the second test, this means that I’d not be in your office, nor would the work being done be subject to the processes involving the running of your business. Specifically, let’s say, I structured my time to work on your books on Tuesdays. Monday through Wednesday would work as usual for you, no change in the course of business whether I am actively working on your books, or not. Another example would be if someone were building something you sell, that would be an employee; however, if they are building you a new window in your office, that would be an independent contractor.

Lastly, the third test means that when not working on your books, I still typically work as a bookkeeper; I’m not a carpenter, physical therapist, or dog walker acting as a bookkeeper. Because Profit & Equity, LLC is an established limited liability corporation (LLC), this covers the test as a solid “yes”. If however, you are hiring a “sole proprietor” to work on something for you, there might be some questions raised if the first two tests are not a very solid “yes”.

So, bottom line: if there is a “no” for any of the three conditions above, the employee should be paid as a W2 employee.

It’s not always that black and white. It also varies by state. However, the penalties are quite severe. The IRS and the Department of Labor can levy individual penalties for each infraction they find. This could include all of the unpaid withholdings that weren’t applied, interest on unpaid worker’s compensation insurance and taxes, a $1000 fine per employee per year, and even imprisonment for up to one year per infraction. This would quickly add up to thousands of dollars if lost wages due to imprisonment becomes a factor.

For further clarification or if there are any questions on this, we are happy to help. Set up a call with us via email at julia@profitandequity.com or call us directly at (508) 939-7511.

Resources

Department of Labor. “Misclassification of Employees as Independent Contractors” Accessed Dec 12, 2021.

Internal Revenue Service. “Present Law and Background Relating to Worker Classification for Federal Tax Purposes” Accessed Dec.15, 2021.

Internal Revenue Service. “Publication 15-A (2021), Employer’s Supplemental Tax Guide, 1. Who Are Employees?” Accessed Dec. 4, 2021.

Internal Revenue Service. “Publication 15-A (2021), Employer’s Supplemental Tax Guide, Misclassification of Employees.” Accessed Dec. 4, 2021.

Internal Revenue Service. “Publication 15-A (2021), Employer’s Supplemental Tax Guide, 2. Employee or Independent Contractor?” Accessed Dec. 4, 2021.Kagan, J. (04 Dec 2021). IRS Publication 15-A: Employer’s Supplemental Tax Guide. Investopedia.com. Retrieved from: IRS Publication 15-A: Employer’s Supplemental Tax Guide (investopedia.com)