Anyone who owns a business knows that they have to be a jack of all trades.

One thing that business owners learn the hard way is that managing the books is a skill set that is nothing like balancing a checkbook. Bookkeeping is its own practice that needs to be done correctly and is not very intuitive. It can also be extremely time-sensitive, and a lot of business owners find it difficult to keep up with the time management of bookkeeping.

Here are some signs that it is time to either get some help or hand it off completely:

1. If you haven’t reconciled your accounts for three months (or ever), it’s time to outsource your bookkeeping.

Your focus needs to be on your business. While your company’s finances are an important aspect to focus on, you do not need to be the one managing it to leverage the knowledge derived from it. More to the point, your books can only give you relevant information if they are current and updated. If the bookkeeping is behind, your business is suffering.

2. If you can’t make heads or tails of your financial reports, it’s time to outsource your bookkeeping.

Those reports are for you to understand the financial state of your business. If you can’t understand what they are telling you, you will not be able to make the best decisions for your business.

Taking it one step further, your balance sheet and income statement work together to paint a picture of the financial health of your business, and that picture is incomplete without the Cash Flow Statement.

If you find yourself not understanding how to do these reports, it might be best to seek assistance and take it off your worries.

3. If you are seeking financing, it’s time to outsource your bookkeeping.

When seeking loans, many banks will require extensive and detailed financial reporting that needs to be accurate and compliant with GAAP standards.

Without training, this is hit or miss for many business owners and you could miss out on some important opportunities if you get it wrong. Ensure they have the most accurate information so you can get the best deal!

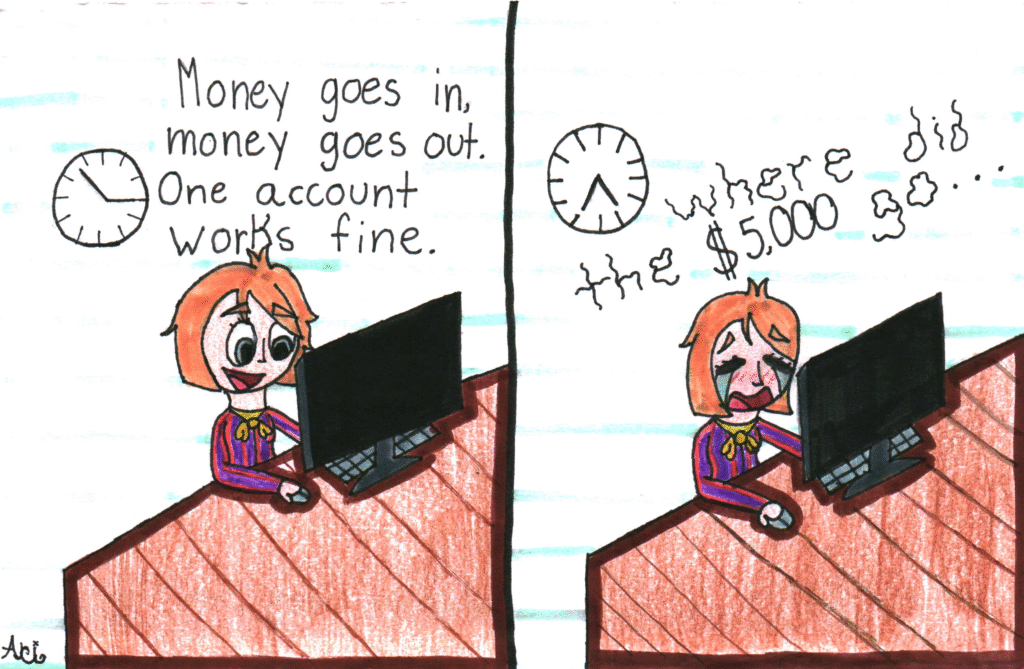

4. If you are paying overdraft fees, it’s time to outsource your bookkeeping.

No one likes getting Notice of Overdraft letters from their bank. If this is happening, it’s an indication that your business is having some cash flow issues. There are many different fixes for this depending on your business model. Talk to a bookkeeper to find out more!

5. If you are facing an audit, it’s time to outsource your bookkeeping.

Honestly, if you’re already dealing with an audit and don’t have a bookkeeper, you’re behind the curve. A good bookkeeper helps reduce the chances of being audited in the first place by keeping your financials clean and compliant.

That said, it’s never too late to get help. During an audit, a bookkeeper can step in to organize your records, manage information requests, and serve as a helpful liaison between you and the auditors.

Beyond audits, having a bookkeeper gives you more clarity, more time to focus on your business, and peace of mind knowing your numbers are in order.