Does your stomach drop when you check your business bank account?

Do you find yourself wondering, “Where did all the money go?” Or worse—racking up mountains of debt just to cover business expenses?

If this sounds familiar, it’s likely not just a money issue—it’s a lack of an effective cash flow strategy.

You’re not alone. Many businesses struggle with cash flow. Some take a “work harder” approach: If I can just get more clients, we’ll be fine. Others fall into denial: I’ll just put it on the credit card until things work themselves out. And some avoid the issue altogether, telling themselves, “It’s normal for businesses to be short on cash.”

The problem? That’s not sustainable.

A sound cash flow strategy won’t just help you sleep better at night—it ensures you can pay your bills, cover payroll and taxes, and build liquidity to strengthen your business.

Let’s Look at Some Strategies to Get Started

Step 1: Know Your Flow

Before you can fix it, you have to understand it.

1. Cash Flow Statement: Your New Best Friend 🧾

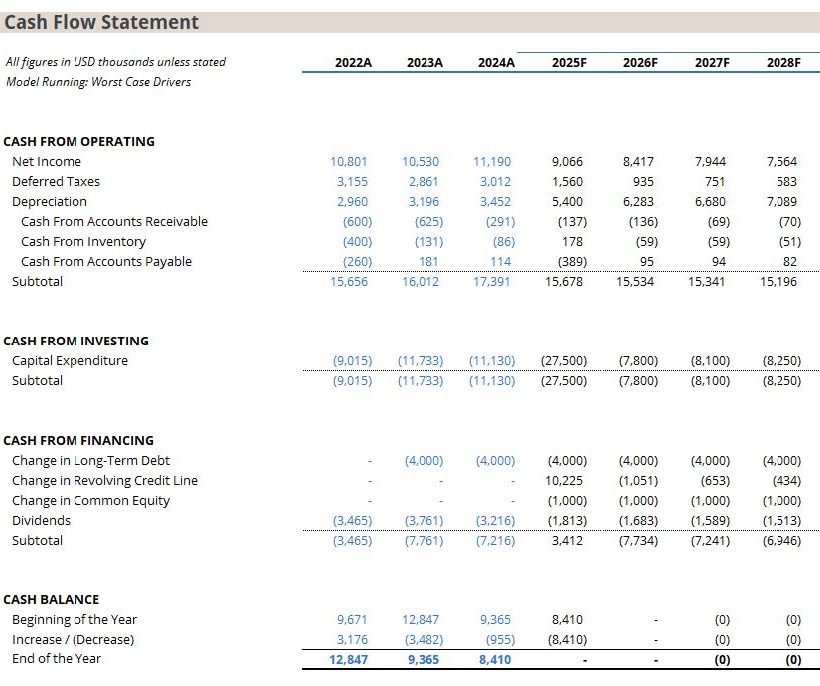

Many business owners and CEOs aren’t familiar with—or don’t take the time to understand—the Cash Flow Statement (CFS), one of the three core financial statements. The CFS provides critical insight into how cash is actually moving in and out of your business and is a powerful tool for informed decision-making.

2. 13-Week Forecast: Looking Ahead 📆

Another powerful cash flow tool is the 13-week rolling forecast. This forecast outlines upcoming expenses over the next three months and compares them to available cash. By keeping it rolling and updating it weekly, you maintain a forward-looking view of your financial position—so you’re always ahead of the game, not reacting too late.

3. Expense Audits: Keeping Track 🕵️

We’ve all seen those ads asking people how many subscriptions they have—and they’re almost always wrong. Businesses fall into the same trap.

Every few months, review your last three months of expenses and ask:

- Are there new expenses?

- Have rates increased?

- Are you paying for services you no longer need?

Step 2: Fix Your Flow

1. Allocation Accounting: Separate the Pots 🏦

You need to ensure that not all your eggs are in one basket. Using multiple accounts helps safeguard your funds and ensures money is available when and where you need it. Allocating revenue intentionally—such as setting aside 16% of income for taxes—supports long-term liquidity.

At a minimum, create separate accounts for:

- Operations

- Payroll

- Tax Hold

- Runway

Pro Tip: Tax and Runway funds should be kept in savings accounts—earn interest while protecting your cash.

2. Aging Payables & Receivables: Don’t Let Cash Get Stuck ⏱

For Receivables:

- Offer early payment incentives (e.g., 2% off if paid within 10 days)

- Send consistent reminders

- Establish clear enforcement policies (late fees, service suspension after 45 days, etc.)

Reviewing your aging report weekly is crucial to ensuring that you stay on top of who has paid, and who hasn’t.

For Payables:

Many businesses employ a delay, delay, delay approach – some to the point of hurting their vendors’ businesses. This seems one-sided and perhaps not the best approach. Many vendors offer incentives of their own, helping you save on early payments. You can discuss with them the possibility of monthly or quarterly installments.

3. Profitability Check: Zoom In 🔍

Ensure that your budgeted revenue aligns with your actuals and assess profitability vigilantly. Net profit on your P&L is not enough; it’s too “zoomed out”. You should be reviewing profitability by revenue stream, client type, or even each client, depending on your business model. Examining the details is just as important as understanding the bigger picture.

Your Cash Flow Strategy

Building a cash flow strategy is not a “set it and forget it” process. Each month you’ll discover nuances in your cash flow that will need additional attention. Your strategy should be dynamic and changeable. One month, you may need to do a full assessment of profitability, the next an expense audit, followed by a detailed vendor assessment. Each tool has a job and should be utilized accordingly. Once you’ve established a strategy, you’ll need to revisit as your business grows and changes. Overall, managing your cash flow is the best way to stabilize your business.

We hope this helps you take control of your business finances. If you feel you need more guidance, we do offer a Backseat Bookkeeping Service, a 1:1 1-hr training session where we help you make sense of your books, explain the bookkeeping processes, or just answer any bookkeeping questions you may have.